Smart Funding Solutions for Small Business Startups

Starting a small business is an exciting journey, but one of the biggest challenges entrepreneurs face is securing the funds necessary to get their business off the ground. Funding options for startups can vary widely, and choosing the right one is critical for long-term success. This comprehensive margie washichek guide explores various small business funding options for startups, their advantages, disadvantages, and tips for making the right decision.

Why Funding Is Crucial for Startups

Starting a business requires capital to cover initial expenses such as product development, marketing, staffing, and operational costs. Lack of funding is one of the primary reasons many startups fail within their first few years. Adequate funding not only provides the resources to get started but also offers a safety net for unforeseen challenges.

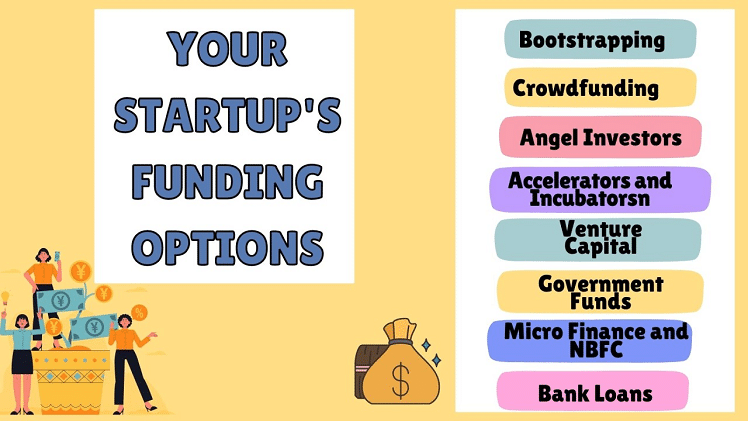

Types of Startup Funding at a Glance

Below is a comparison of common funding options available for startups:

| Funding Option | Funding Source | Typical Amount | Repayment Terms | Best For |

| Personal Savings | Individual | Varies | None | Entrepreneurs with some capital |

| Angel Investors | High-net-worth individuals | $10,000 – $500,000 | Equity stake in the company | Innovative ideas and growth potential |

| Venture Capital (VC) | VC firms | $500,000 – $10M+ | Equity stake in the company | High-growth startups |

| Bank Loans | Banks | $5,000 – $500,000 | Monthly repayment + interest | Established credit and business plan |

| Crowdfunding | Online platforms | Varies widely | None of the pre-orders | Early-stage ideas with community support |

| Government Grants | Local or federal governments | $10,000 – $100,000+ | None | Specific industries or demographics |

Each of these options caters to different types of businesses, needs, and stages of growth. Let’s explore these funding options in more detail.

Self-Funding or Bootstrapping

Self-funding, also known as bootstrapping, involves using personal savings, family contributions, or reinvesting early profits to start your business.

Advantages of Self-Funding

- Complete control over the business

- No need to repay loans or give up equity

- Builds financial discipline

Disadvantages of Self-Funding

- Limited resources, especially for scaling

- High personal financial risk

- Slower growth due to funding constraints

Angel Investors

Angel investors are individuals who provide capital in exchange for equity ownership in your company. They are often willing to take on more risk than traditional lenders.

Advantages of Angel Investors

- Flexible funding terms

- Access to mentorship and networking opportunities

- Suitable for early-stage businesses

Disadvantages of Angel Investors

- Loss of full ownership

- Potential differences in vision between founders and investors

Venture Capital

Venture capital (VC) is a popular funding source for startups with high-growth potential. VC firms typically invest significant amounts in exchange for equity stakes.

Advantages of Venture Capital

- Large amounts of funding

- Access to industry expertise and connections

- Helps in scaling rapidly

Disadvantages of Venture Capital

- Pressure to deliver high returns

- Loss of significant equity

- Intense scrutiny and oversight

Bank Loans

Bank loans remain one of the most traditional ways to finance a small business. While harder to secure, they are ideal for businesses with solid financial plans.

Advantages of Bank Loans

- Retain full ownership of the business

- Fixed repayment terms

- Access to substantial funding amounts

Disadvantages of Bank Loans

- Requires strong credit and a business plan

- Interest rates and repayment pressures

- Not suitable for high-risk startups

Crowdfunding

Crowdfunding platforms like Kickstarter, Indiegogo, and GoFundMe allow startups to raise funds from a large number of people, often in exchange for early access to products or perks.

Comparison of Major Crowdfunding Platforms

| Platform | Best For | Fees | Funding Model | Example Campaigns |

| Kickstarter | Creative projects | 5% platform fee | All-or-nothing funding | Tech gadgets, art projects |

| Indiegogo | Innovative ideas | 5% platform fee | Flexible or all-or-nothing funding | Startups, innovative products |

| GoFundMe | Personal causes, nonprofits | 2.9% + $0.30/transaction | Flexible funding | Community initiatives, support campaigns |

| Patreon | Content creators | 5-12% of monthly income | Subscription-based | Podcasts, creators |

Advantages of Crowdfunding

- Access to a global audience

- No need to repay funds (depending on the model)

- Builds a loyal customer base early on

Disadvantages of Crowdfunding

- Highly competitive

- Requires significant marketing effort

- Success is not guaranteed

Government Grants and Programs

Governments often provide grants, subsidies, or low-interest loans to small businesses in specific industries or demographics.

Advantages of Government Grants

- No repayment required

- Ideal for businesses in targeted sectors (e.g., technology, green energy)

- Boosts credibility

Disadvantages of Government Grants

- Lengthy application process

- Competitive and specific eligibility criteria

- Limited funding amounts

Business Incubators and Accelerators

Startup incubators and accelerators provide not only funding but also mentorship, office space, and networking opportunities.

Advantages of Incubators and Accelerators

- Holistic support beyond funding

- Access to industry experts

- Builds credibility and investor interest

Disadvantages of Incubators and Accelerators

- Competitive application process

- Often require equity in exchange for support

- May not suit businesses that prefer independence

How to Choose the Best Funding Option for Your Startup

Selecting the right funding option depends on your business model, industry, growth plans, and risk tolerance. Consider these factors:

Business Stage: Early-stage startups might lean toward bootstrapping, angel investors, or crowdfunding, while growth-stage businesses may require venture capital or bank loans.

Risk Appetite: If you’re willing to give up equity, angel investors and VCs can provide significant funding. For those who prefer control, loans or self-funding are better.

Industry and Location: Government grants or crowdfunding campaigns may cater specifically to certain sectors or regions.

Scalability Needs: Venture capital and incubators are ideal for startups with high growth potential.

Conclusion

Securing funding for your startup is one of the most critical steps in building a successful business. With a variety of options available—from self-funding to government grants and venture capital—there is no one-size-fits-all solution. constantine yankoglu photo Evaluate your business needs, goals, and resources to determine the funding source that best aligns with your vision. Remember, the right funding decision can set the foundation for sustainable growth and success.

FAQs

What is the best funding option for a tech startup?

Tech startups often benefit from venture capital funding due to the potential for high returns and scalability. Crowdfunding is also an excellent choice for innovative tech products.

Are there any funding options for startups with bad credit?

Yes, alternatives like crowdfunding, angel investors, and government grants may be available to startups with bad credit, as they don’t rely on creditworthiness.

How do I qualify for government grants?

Eligibility depends on the specific grant. Typically, you need to align with the grant’s purpose (e.g., green energy, innovation) and submit a detailed application with a business plan.

How long does it take to secure funding from an angel investor?

The process can take several weeks to months, depending on the investor’s due diligence process and negotiations.

Is crowdfunding a reliable source of funding?

A: Crowdfunding can be reliable but requires extensive marketing and planning. Success depends on the strength of your campaign and your product’s appeal.